Two weeks before ban, EU still imports 15% of crude oil from Russia

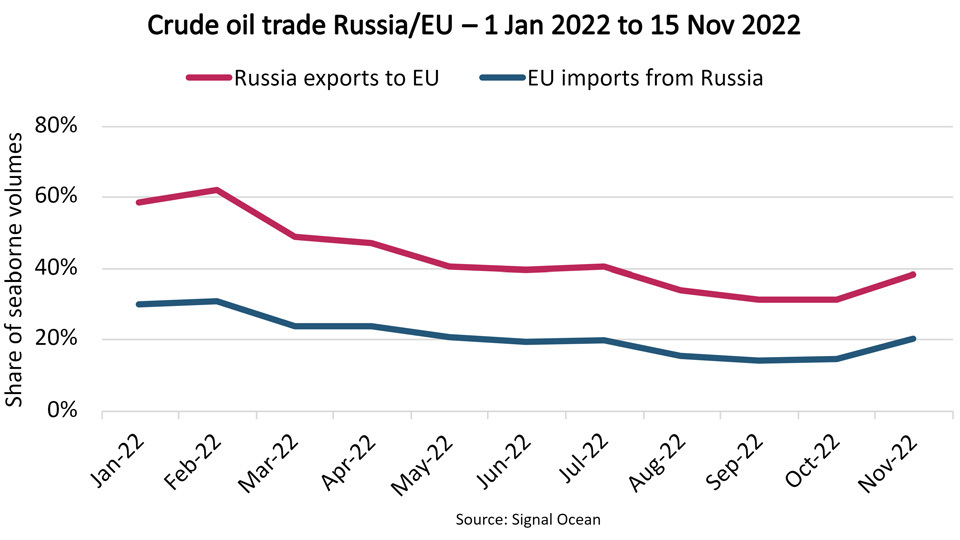

At the start of this year, Russia exported 11 million tonnes crude oil by ship to the EU each month. It equalled 60% of all Russian seaborne crude oil exports and 30% of the EU’s seaborne crude oil imports.

In the first half of November, Russian seaborne crude oil exports to the EU amount to 3.7 million tonnes, equal to 38% of all Russian seaborne exports and 20% of EU seaborne crude oil imports. The figures are slightly higher compared to September and October when Russia to EU seaborne crude oil volumes made up 31% of total Russian seaborne exports and 14% of EU’s seaborne crude oil imports.

With less than two weeks to go before the EU’s ban on Russian crude oil import takes effect, imports from Russia still make up 15-20% of the EU’s seaborne crude oil imports. So far, buyers in the EU have found new suppliers for about half of its previous Russian crude oil imports but still need to find new suppliers for about 5.5 million tonnes of crude oil per month.

So far, the shift in buyers of Russian crude oil has benefitted Suezmax ships. In the beginning of the year, they exported approximately 25% of all Russian seaborne crude oil exports but now handle approximately 40% of all exports. Aframax ships have lost share, due to the reduction in crude oil export to the EU.

VLCC and Suezmax ships have increased their share of EU crude oil imports. After peaking at 20% in August, VLCCs now carry about 10% of all crude oil into the EU, double of what they did in the beginning of the year. Suezmaxes have increased their share from 30% to 45% whereas Aframaxes have lost share due to the lower imports from Russia.

Russia has found new buyers in India and China and each now imports about 25% of Russian seaborne crude oil exports, up from respectively 0% and 15% in the beginning of the year. The EU has found new supply in many locations with the Persian Gulf, West Africa, and East Coast South America standing out. All in all, average haul for crude tankers is increasing and will increase further once the ban takes effect.

Despite the coming ban, Russia has exported 10% more via sea in 2022 than in 2021. However, the volumes have remained 7% lower than in 2019. Looking forward, both the US Energy Information Administration (EIA) and the International Energy Agency (IEA) forecast that Russian oil production will reduce by nearly 2 mbpd in 2023 compared to pre-war production, nearly a 20% reduction. The assumption is that Russia will not be able to find new buyers for all the remaining crude oil and oil products previously destined for the EU. In addition, the final structure of the oil price cap currently being discussed amongst EU, USA, and their allies could end up restricting exports as well as availability of shipping capacity.

The exports lost could instead move out of North and South America where oil production is expected to increase and make up for the lost Russian production.

Feedback or a question about this information?

BIMCO's Shipping number of the week

- Dry bulk newbuild contracting fell 34.2%, despite a strong market

- Newbuilding prices climb 3% to highest level in 16 years

- Charter owners’ share of fleet has fallen to 40%, lowest since 2002

- Dry bulk sailing distances jump 31% for routes using the Panama Canal

- Peak in China’s coal demand in sight as renewables jump 12%

ELSEWHERE ON BIMCO

Contracts & Clauses

All of BIMCO's most widely used contracts and clauses as well as advice on managing charters and business partners.

Learn about your cargo

For general guidance and information on cargo-related queries.

BIMCO Publications

Want to buy or download a BIMCO publication? Use the link to get access to the ballast water management guide, the ship master’s security manual and many other publications.