Please select a reason for contacting BIMCO from the list above to find the best contact number

Market analysis

-

Dry Bulk Shipping Market Overview & Outlook April 2024

Normalisation of ship routings could cool dry bulk market

-

Container Shipping Market Overview & Outlook March 2024

Red Sea attacks temporarily increase demand for ships

-

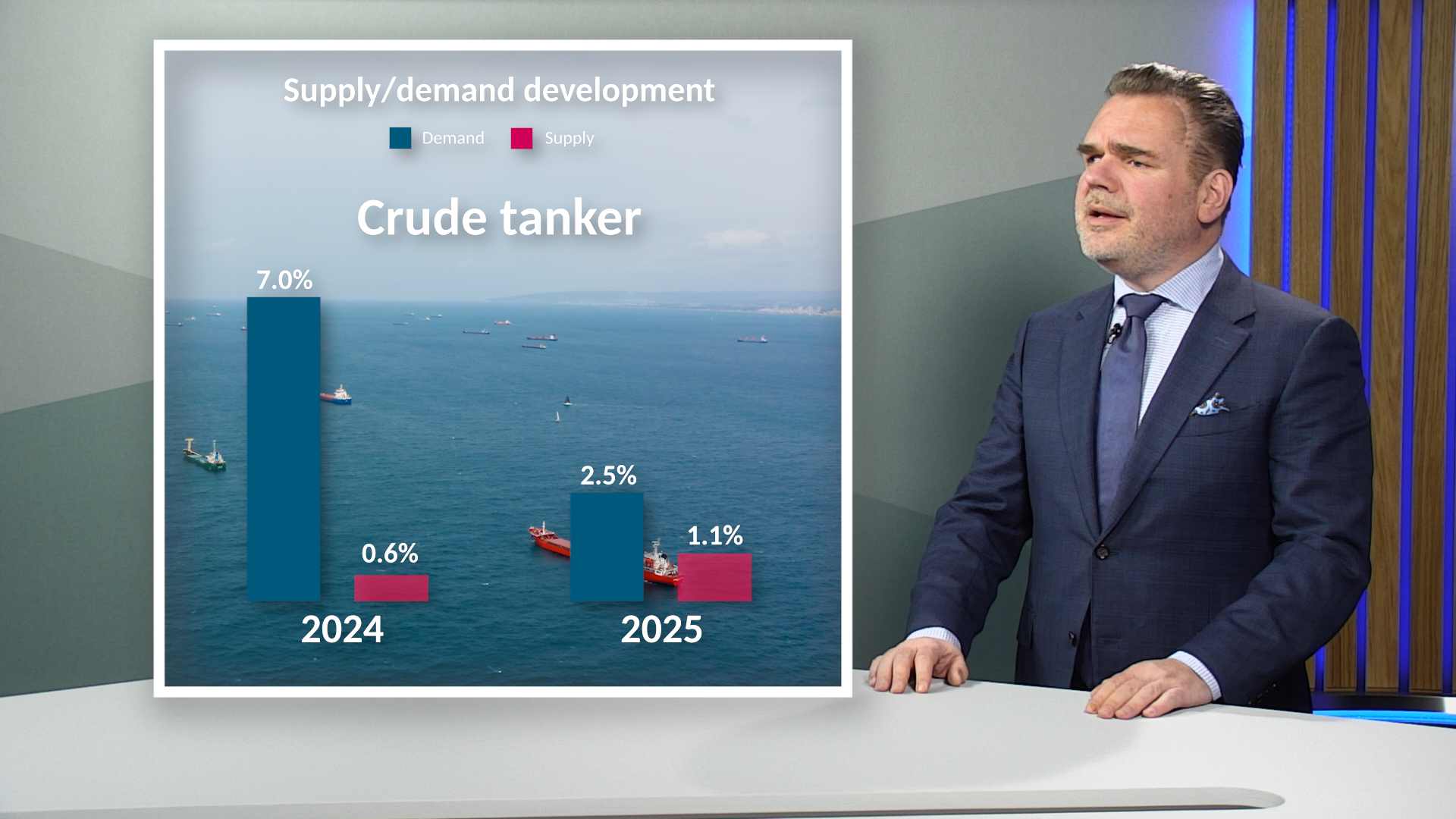

Tanker Shipping Market Overview & Outlook February 2024

Market strengthens despite slowing oil demand growth

-

Dry Bulk Shipping Market Overview & Outlook January 2024

Energy transition curbs demand growth

-

Tanker Shipping Market Overview & Outlook Q4 2023

Growing oil market imbalances drive tanker improvements

-

Dry Bulk Shipping Market Overview & Outlook Q4 2023

Muted fleet growth helps maintain market balance