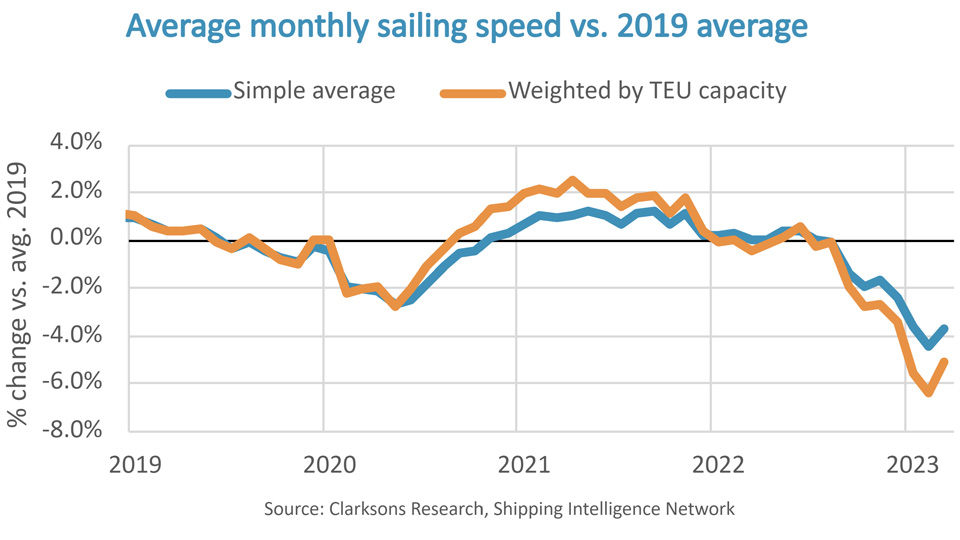

Liner supply falls as operators reduce average sailing speed by 4%

When ships adjust their speed, the transport capacity is affected and the adjustment can be an effective way of managing capacity supply. Lower sailing speeds also reduce bunker oil consumption and greenhouse gas emissions. Slow steaming was first introduced in the aftermath of the financial crisis, cutting sailing speed on mainline routes by as much as 20%.

Average sailing speed has reduced significantly, although the traditional faster speed in the head-haul direction remains. The larger ships sailing intercontinental trades have also continued to sail faster than the smaller ships in intra-regional trades. These traditions may, however, also be about to change.

In 2019, the largest ships sailed on average 2.6 knots faster than the smallest ships. During the first quarter of 2022 that speed difference had narrowed to 1.8 and further to 1.6 during the first quarter of 2023. As a result, the average sailing speed weighted by the ships’ TEU capacity fell by 6% y/y in the first quarter of 2023 whereas the simple average sailing speed fell only 4% y/y. Supply has therefore decreased faster than the sailing speed.

The speed difference between head-haul and back-haul direction may also be reduced in the future. To comply with the Energy Efficiency Existing Ship Index (EEXI) some ships have had to install Engine Power Limitations (EPL), reducing their top speed. In order to maintain the buffer between the top speed and scheduled speed (allowing ships to recover from delays in port or due to weather) the scheduled speed must be reduced. This will naturally impact mostly the faster head-haul direction and narrow difference in speed between the directions. The Carbon Intensity Indicator (CII) regulation and overall greenhouse gas emission targets may drive further reductions in sailing speed.

In part, the lower average sailing speed may be due to improved port congestion and some ships returning more slowly to Asia-Pacific than normal. However, we still believe it is a good indication of things to come. As highlighted in our Container Market Overview & Outlook reports throughout 2022, we believe that sailing speeds could fall by 10% before 2025.

Feedback or a question about this information?

BIMCO's Shipping number of the week

- Dry bulk newbuild contracting fell 34.2%, despite a strong market

- Newbuilding prices climb 3% to highest level in 16 years

- Charter owners’ share of fleet has fallen to 40%, lowest since 2002

- Dry bulk sailing distances jump 31% for routes using the Panama Canal

- Peak in China’s coal demand in sight as renewables jump 12%

ELSEWHERE ON BIMCO

Contracts & Clauses

All of BIMCO's most widely used contracts and clauses as well as advice on managing charters and business partners.

Learn about your cargo

For general guidance and information on cargo-related queries.

BIMCO Publications

Want to buy or download a BIMCO publication? Use the link to get access to the ballast water management guide, the ship master’s security manual and many other publications.