Jet fuel volumes down 27% on 2019, Chinese re-opening to offer relief

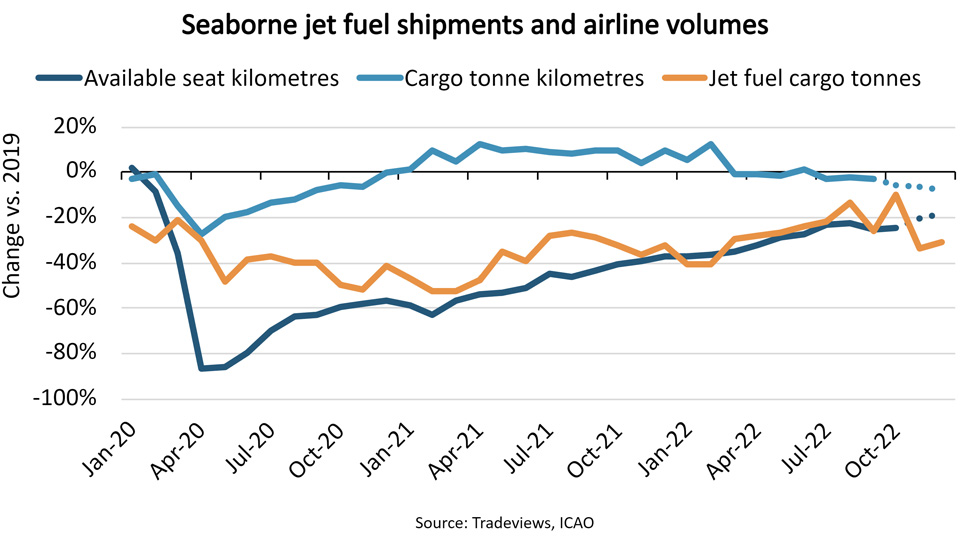

Initially, air cargo volumes fell as well but saw volumes climb 5-10% above pre-pandemic levels in 2021. During 2022, the surge in cargo volumes slowed along with global economic growth prospects whereas passenger traffic continued to recover. Now, the relaxation of COVID restrictions in China offers hope for a recovery in the airline industry as well as in jet fuel shipments.

The International Civil Aviation Organization (ICAO) estimates that available seat kilometres were 25% lower than 2019 levels in October 2022, while cargo tonne kilometres were 4% lower than 2019 levels in September 2022. Tradeviews estimates that seaborne jet fuel cargo volumes in 2022 ended 27% lower than in 2019. However, the recent relaxation of COVID policies in China offers hope that 2023 may end very differently.

In a recent report, Avolon, the world’s second largest jet lessor, predicts that the changes in Chinese COVID policies will help air traffic return to pre-pandemic levels already in June 2023 and that half of all capacity growth during 2023 will be in Asia.

In September 2022, available seat kilometres in the Asia-Pacific region were 48% lower than in 2019. Combined, the Asia-Pacific region, Europe, and North America account for more than 80% of global airline capacity, and capacity in the latter two regions were down 17% and 7% respectively. A recovery in the number of travellers to and from China will not only help narrow the gap to 2019 capacity in the Asia-Pacific region, but in all regions. This could bring airline capacity back to 2019 levels as well as spur an increase in the seaborne jet fuel trade.

If global airline traffic returns to 2019 levels by mid-2023 and continues to grow thereafter, global seaborne jet fuel trade could end 2023 just 5-10% short of the pre-pandemic level. That would mean year-on-year growth versus 2022 of 25-30% while adding as much as 2% to the overall clean petroleum products’ seaborne cargo volume.

Product tankers are already predicted to benefit from an increase in average sailing distances in 2023 due to the upcoming EU ban of Russian petroleum products. An increase in jet fuel volumes will further increase demand for product tankers while the fleet capacity is expected to grow only 1%.

While an uncertain outlook for the global economy remains a cause for concern, the re-opening of China increases the likelihood that tonne miles demand for product tankers and freight rates will increase regardless.

Feedback or a question about this information?

BIMCO's Shipping number of the week

- Dry bulk newbuild contracting fell 34.2%, despite a strong market

- Newbuilding prices climb 3% to highest level in 16 years

- Charter owners’ share of fleet has fallen to 40%, lowest since 2002

- Dry bulk sailing distances jump 31% for routes using the Panama Canal

- Peak in China’s coal demand in sight as renewables jump 12%

ELSEWHERE ON BIMCO

Contracts & Clauses

All of BIMCO's most widely used contracts and clauses as well as advice on managing charters and business partners.

Learn about your cargo

For general guidance and information on cargo-related queries.

BIMCO Publications

Want to buy or download a BIMCO publication? Use the link to get access to the ballast water management guide, the ship master’s security manual and many other publications.